TNS Experts

This post was submitted by a TNS experts. Check out our Contributor page for details about how you can share your ideas on digital marketing, SEO, social media, growth hacking and content marketing with our audience.

A payment gateway is crucial to the security and growth of your business online. Learn what a payment gateway is, its benefits, and how to choose the right one for your needs.

Do you let potential customers make a purchase using their preferred payment methods? If not, you’re taking away from their convenience.

Creating a safe and frictionless shopping experience for potential customers in an increasingly digital world is non-negotiable.

When SuperOffice asked 1920 business professionals about their priorities for the next 5 years, customer experience came in first (beating product and pricing).

And a big part of this experience is how you process digital payments. A payment gateway can make it easy for customers to buy from you, improving overall sales.

In this article, we’ll walk you through what a payment gateway is, how it works, and all you need to know to choose the right payment solution for your business.

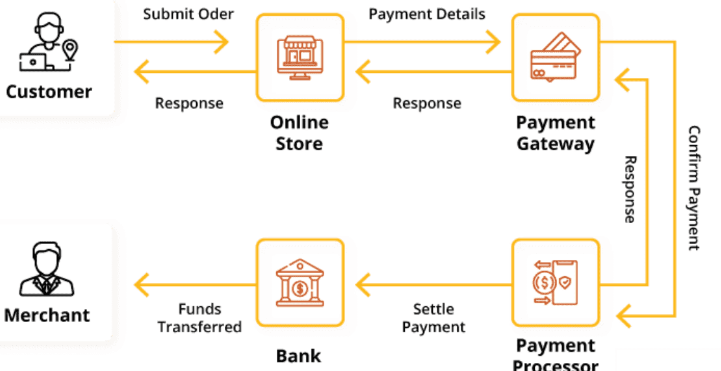

Whether you run an e-commerce website or an in-person establishment, a payment gateway is a front-end technology that helps you transmit customer payment data to your bank account for processing.

As a merchant, you can use this technology to accept your customers' debit and credit card payments. In other words, it’s a service that links a bank account and the relevant payment processor. Here’s a visual depiction of how it works:

Source: OroCommerce

A payment gateway can transmit transaction data either way:

And in doing so, it also takes care of authorizing different modes of digital payments such as credit cards, internet banking, UPI (Unified Payments Interface), and more.

A payment gateway doesn’t just streamline your customers’ shopping experience but also lets you save the cost of using multiple payment vendors.

Besides that, it comes with value-added features like software integration and performance reporting that can help take your business operations to the next level. Let’s take a look at the key benefits in more detail.

Do you know that the average shopping cart abandonment rate globally is a whopping 70%?

For the uninitiated, when a visitor adds a product to their cart but leaves without completing the order for some reason, this phenomenon is known as shopping cart abandonment. And as you can see from the above statistics, it is one of the prominent causes of lost sales in the e-commerce space.

That’s where a good payment gateway can help and get you more conversions. Since it allows users to choose from multiple payment options, they find purchasing easy.

The options typically include direct bank transfers, different types of credit cards, digital wallets, and much more. That means you can support whatever payment methods your target audiences prefer and keep them from turning away from your store.

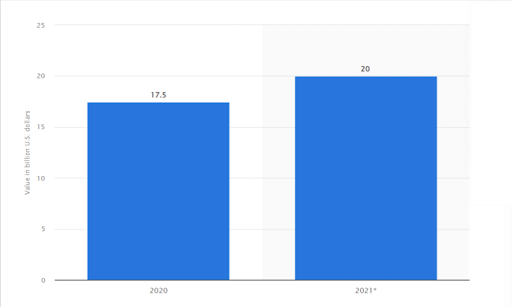

Cyber fraud accounted for over USD 20B in global economic losses in 2021, up from 17.5B in 2020, according to a report by Statista.

Source: Statista

Digital advancements in recent years have revolutionized commerce worldwide. But the sad reality is that cybercriminals have honed their techniques to defraud merchants and customers over time. And payment gateways go a long way in ensuring that both these parties remain safe.

With a reputed payment gateway solution, you can allow customers to safely store sensitive information in the Payment Card Industry Data Security Standard (PCI-DSS) portal.

On top of that, modern payment gateways also come with several fraud screening features like CVV (Card Verification Value), payer authentication, and AVS (Address Verification Service).

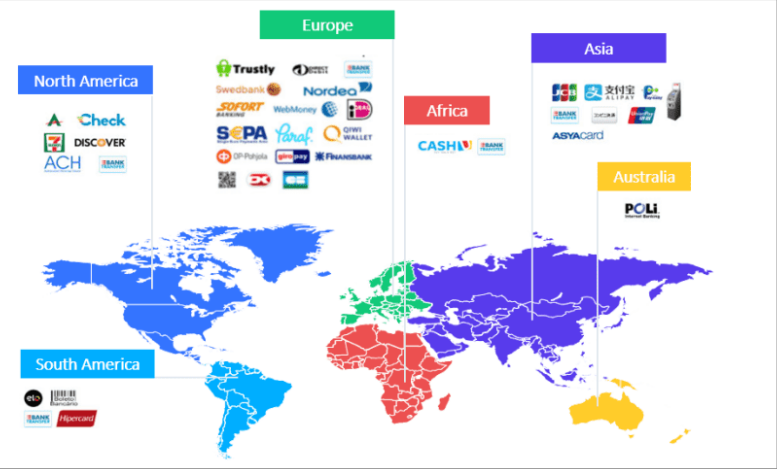

Reaching target markets outside of your native country is easier said than done. Apart from different currencies and payment methods, you may have to navigate many other operational complexities. Not to mention the cost of handling these challenges.

Source: Verifone

But the good news is that this is another area where payment gateways can come in handy. They empower you to accept payments from people outside your home country. In addition, you can also let these people make payments in their local currency.

The bottom line? A payment gateway can be a huge asset if one of your goals is to expand your business to international markets.

Considering the advantages you can get from a solid payment gateway, you must consider using one. But with so many payment gateway providers, which one should you select? The following factors will help you make the right choice.

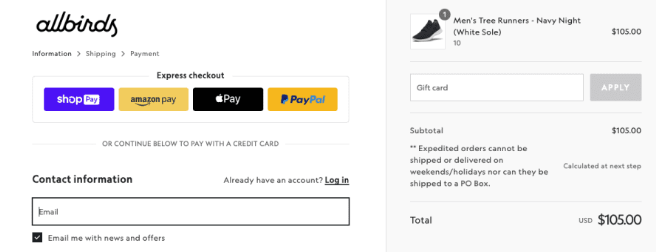

Modern consumers are paying for products and services in several different ways. Do you know how your customers want to pay?

Knowing your buyers’ preferences will help you get a more aligned payment gateway.

For example, the AllBirds checkout page meets consumers where they are and doesn’t force them to use an undesirable payment method. This way, it ensures that the buyers are happy.

Source: Convertcart

Not just that. Selecting a payment gateway that meets consumer needs will get paid faster, reduce security risks, and contribute to a smooth operation.

Check how much the payment gateway charges for different types of transactions. Most payment gateways have a “per transaction” fee. And some may also have a fixed monthly payment on top of the transaction charges.

For example, for a transaction, PayPal’s processing fee ranges from 1.9% to 3.5%. There could also be a fixed fee ranging from 5 to 49 cents. The overall amount depends on the exact PayPal product you are using.

Consumers still hesitate to make online payments due to many security concerns. And with all the threats prevalent around the web, can you blame them? These include:

The more opportunities fraudsters have to rip customers off, the more costly it is for sellers. In fact, e-commerce fraud is forecasted to reach USD 1.5 billion in 2022 in Europe alone, let alone the rest of the world.

You must invest in fraud management and ensure your buyers' safety as a merchant. And while there is no such thing as 100% security, a high-quality payment gateway can go a long way in minimizing security risks.

Google Pay, for example, replaces a customer’s actual credit card details with a virtual card for added security.

So when choosing a payment gateway, make sure its parent company is PCI compliant and has a good reputation in the industry. Some gateways - known as 3D gateways - provide additional security by requesting payment confirmation.

Check what anti-fraud measures payment gateways offer, such as Tokenization and hosted payment forms. These features ensure sensitive transaction details don’t pass through your website. Plus, they help cut your liability in case of a breach.

Most gateway providers boast about the benefits and universality of their solutions. But they may not be as forthcoming about the payment methods they do not support.

You don’t want to go through the effort of implementing a payment gateway only to discover that it can’t accept transactions from certain portals or cards, especially if it’s a portal or card widely used by your customers.

So make sure to consider this when selecting a payment gateway. Authorize.net, for instance, allows buyers to choose from various payment methods, including Apple Pay, PayPal, and other prominent credit card vendors. You might also want to see if the payment gateway allows you to pay offline instead of just online. Options such as a mobile card reader make it possible to accept payments in person.

As your business grows, you may need to customize how your payment gateway looks and functions in association with your website. And you’ll also need it to blend in with the other tools you use.

That’s where third-party integrations come in. The more integrations a payment gateway supports, and the deeper these integrations are, the easier and cheaper it will be for you to customize shoppers’ experiences.

The best payment gateways offer several integrations on both the technical and design levels. Take Stripe, for example. It integrates with popular apps such as Intercom, Xero, and DocuSign or even Stripe integration with Quickbooks is available.

And using a payment gateway with multiple, seamless integrations can improve your data accuracy, productivity, and time management.

If you run your business on the go, a virtual terminal is a game-changer in accepting payments over the phone or via email. It turns your device into a POS system, except on the cloud.

Once you sign up for a payment gateway with a virtual terminal, you can start receiving one-time or recurring ACH, credit, or debit card payments. So make sure to check whether your payment gateway provides this feature.

As you can see, there are many payment gateways with varying features and drawbacks. But if you pick the right one for your company, you can enhance the benefits and work around the limitations.

Moreover, a payment gateway doesn’t have to be set in stone. If you give a payment gateway a shot and realize it’s not for you, you can always switch to the one.

So start with small steps. Pick two or three options in the beginning, and see how they work out for you.

Most of all, keep your customers and their preferred payment methods in mind. When implemented right, a good payment gateway can pay for itself often. Good luck!

You’ll also receive some of our best posts today

This post was submitted by a TNS experts. Check out our Contributor page for details about how you can share your ideas on digital marketing, SEO, social media, growth hacking and content marketing with our audience.

Any online business owner knows that SEO is now...

If you want to ensure that your exhibition is...

User reviews are a game-changer for e-commerce. Consumers rely heavily o...

Don’t miss the new articles!